Studies show good (or not-so-good) money habits start sticking around seven years old. Which means if you want your kiddos to grow up with a positive outlook on money, it’s time to start explaining how finances work. And that might include giving them their own plastic. So we sat down with Jen Hemphill — financial counselor, host of the “Her Dinero Matters” podcast, and a mom of two — for her take on financial literacy for kids. And how you can start prepping yours to manage their own money. Cha-ching.

When is the right time to start talking about money with kids?

Hemphill says there’s no specific age to get started. “As soon as your parent gut tells you it’s time,” she advises. One hint your kid might be ready to learn about money: They’ve spotted a toy they want in the Target checkout line. Because it’s easier to teach kids about money if the lessons center around something that interests them.

Depending on your gut feeling, this could also be your cue to let the kids in on the family budget. Think: Are you saving up for a fun family vacay? Hemphill says displaying a chart or graph is one way to give kids a visual of how close you are to your goal. One example from Hemphill: Say your savings plan includes eating out less, and you let your five-year-old know. From there, you can almost always count on them to hold you accountable. So don’t be surprised if they ask, ‘Why are we going to McDonald's when we could use that money to go to Disney World?’

And in terms of financial literacy for kids: where should we start?

One place to start on financial literacy for kids: the Consumer Financial Protection Bureau. The name might not sound enticing, but Hemphill reassures us, “they have a really great resource called Money As You Grow.” Specifically, it’ll give parents guidance on age-appropriate money lessons. Saving is usually a good starter topic. And you might want to save a convo around credit for when they get a little older.

Hemphill says, as a mom, she was more comfortable with waiting a while before the credit convo. “What I’ve done, and this is not to say this is the way to do it, but I started talking about credit in their teens,” she explains.

Is there a good debit card for kids?

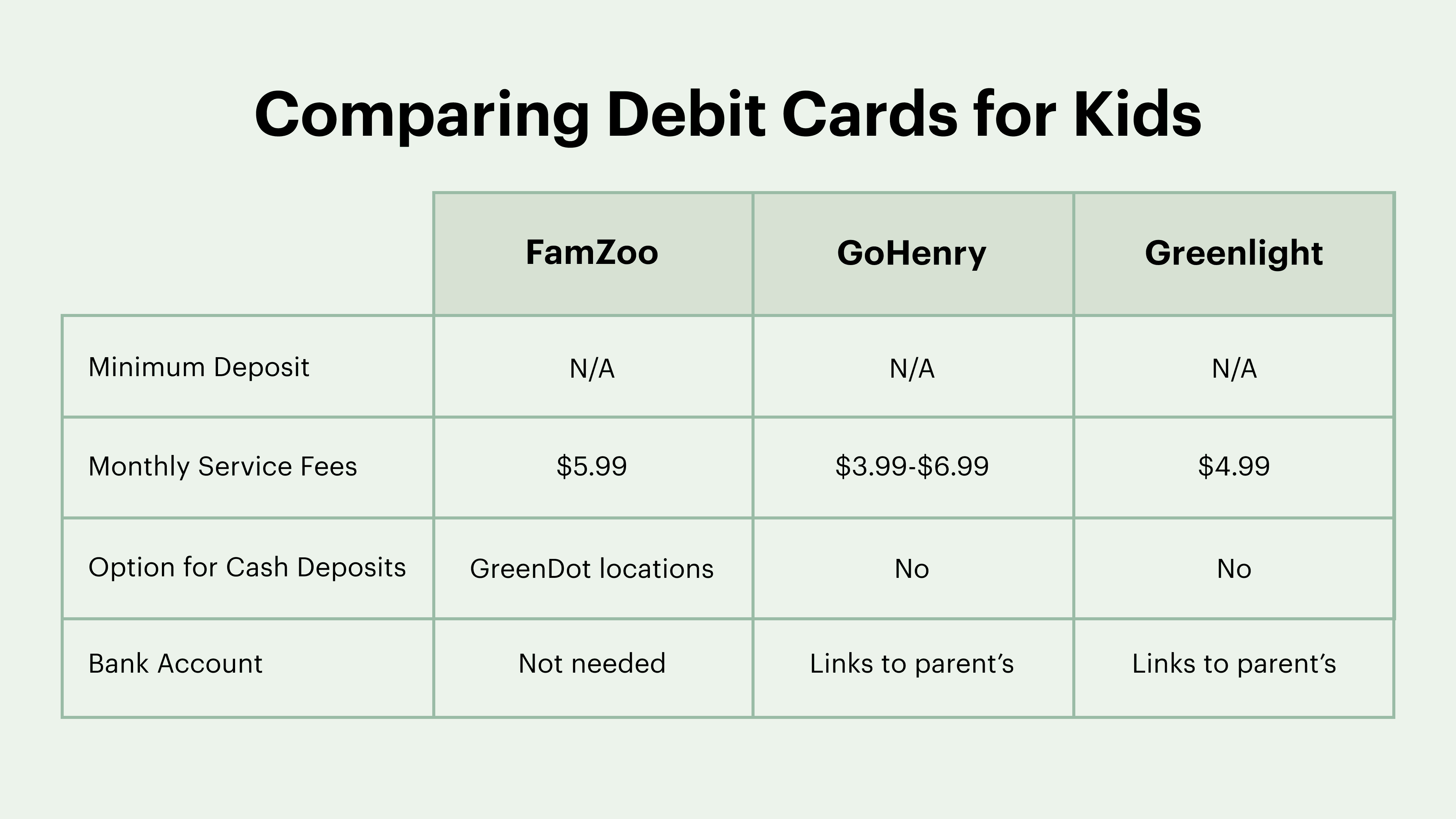

Hemphill says her fave kids debit card is Famzoo. But Greenlight and GoHenry are close runners-up. Here’s theSkimm on each one of her picks:

But these aren’t the only three options out there: Kids debit card options are endless. Hint: Chase, Axos, and other banks offer debit cards for kids. For details on which options work best for you, reach out to your financial institution.

What about a credit card for kids?

Kids aren’t allowed to have their own traditional (aka unsecured) credit cards. It’s illegal thanks to the CARD Act. But a secured kids credit card is possible. Which pretty much works like a debit card, because you have to add money to the card before someone uses it. But there’s a key difference: It impacts your teen’s credit score. So Hemphill says unless you're confident that your kid is super responsible with money, a debit card for kids is the safer option.

Hemphill added that she chose to list her son as an authorized user to help him learn the concept of credit. Which means he could use his credit card and the credit card transactions would be added to his credit history, but Hemphill was responsible for the credit card debt. And she could remove him at any time.

Any major don’ts when it comes to financial literacy for kids?

Hemphill says don’t worry about how little you know. “A lot of people have this mentality that they're not good with money,” Hemphill said. “Don’t allow that to stop you from teaching your kid about money.” Start by teaching what you know. And from there, you can always find finance books and podcasts to help learn more as you go. Another don’t: expect perfection. Hemphill says be flexible with your kids and allow them to make mistakes. That way they’ll learn to be responsible with money.

theSkimm

Like any type of bad habit, less-than-ideal money habits can be tough to break. Which is why financial literacy for kids is crucial for financial success down the road. Pro tip: You don’t have to be a finance pro. Start by focusing on what you know and use any resources you find helpful.

Subscribe to Skimm Money

Your source for the biggest financial headlines and trends, and how they affect your wallet.