Free Advice

These days, making six figures doesn’t necessarily mean owning a home or retiring early are options. For intel on how to save, invest, and spend when you make the big bucks, we tapped Priya Malani, the founder and CEO of Stash Wealth, a company that specializes in working with high-earning millennials and Gen Zers.

What are some common money mistakes young high-earners make?

Putting way too much money in their 401(k). In your 20s and 30s, you don't necessarily need to be saving as much as you possibly can for retirement to stay on track. Sometimes, we tell high-earning young professionals to put less in their 401(k) and divvy up that excess cash to pay down their student loans or upgrade their lifestyle.

What advice would you give to those who want to buy a home?

If you want to buy a home, set a realistic timeline. A lot of that comes down to figuring out how much it’s going to cost. Then, think about how much you want to put down. A mistake we see a lot of millennials make is putting 20% down. If you put 10% down, any additional savings could go toward funding other goals. Like buying a Tesla or traveling more.

What are your top tips for millennials and Gen Zers who want to build wealth?

1. Try reverse budgeting. First, figure out what you’re saving for. Maybe you want to travel or you know you need to buy a wedding gift for a friend. Then, set up a savings account for it. Next, automate a little bit of each of your paychecks into that account so you stay on track. Then, whatever is left in your checking account is yours to spend guilt-free.

2. Use credit cards, don't use debit cards. Debit cards give you no benefits, no protection. Think of your credit card as if it is a debit card when you pay the bill off. Use it to travel with points, build your credit score, and all the other good things.

3. Opt for an online bank. Just because Bank of America was on your college campus, doesn’t mean you have to stick with it. Upgrade to an online bank, many of which offer the best high-yield savings accounts. Make your money work harder for you.

Answers have been edited and condensed for clarity.

Money Win

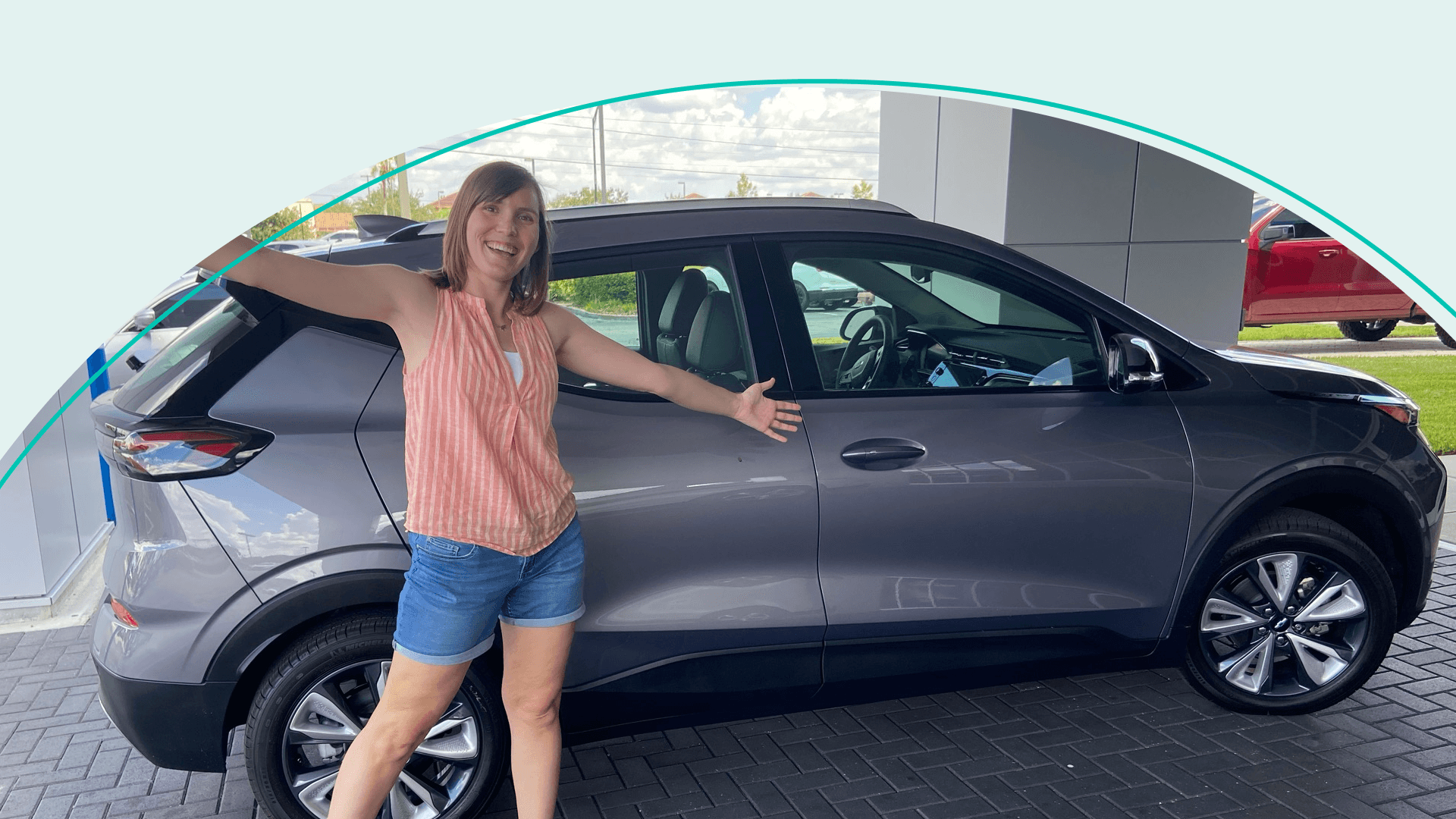

“I just paid off my auto loan for my first-ever new car! It was a five-year loan, and thanks to careful planning and aggressive saving, I paid it off in a year and a half. It’s also 100% electric, so I’m saving on gas and saving the planet at the same time.”

— Kristyn A (FL). We love when going green means saving green, too.

For the Group Chat

What do you call a generation caring for both their parents and kids?

The sandwich generation. Panini or seven-layer dip gen could work, too.

Some Gen Zers are buying homes…

Even if they don’t actually live there.

The secret to sleeping well, exercising more, and having better mental health?

Being a hybrid worker, according to one recent study.

Don’t be so hard on yourself about your money mistakes…

No matter how often TikTokers scold you for it.

Investment Piece

If you’re looking for a hobby that doesn’t involve scrolling on TikTok or Reddit, keep reading for inspo. Beth Moncel, the founder of the food blog Budget Bytes, recently dropped $$$ on her patio garden. Just in time for spring.

Tell us about a recent purchase that felt like an investment.

I bought several fruit trees and bushes from fastgrowingtrees.com to plant in containers on my patio. I bought two banana trees, a lemon bush, a clementine tree, a Cara Cara orange tree, a fig tree, a blueberry bush, and a raspberry bush.

How much did you spend?

Just under $500.

Why do you consider them a worthy investment?

The return is threefold: Gardening is a calming and rewarding hobby (giving me a much-needed offline project), they’ll beautify my patio and create a nice relaxing place to unwind, and hopefully, they’ll provide fresh fruit for years to come! They have a one-year warranty and a gardening help hotline (that I've already used), which minimizes the risk in this investment.

Answers have been edited and condensed for clarity.

Subscribe to Skimm Money

Your source for the biggest financial headlines and trends, and how they affect your wallet.